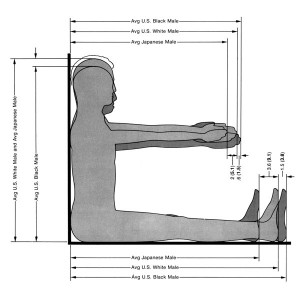

Lafayette Anticipation associate curator Anna Colin talks to artist Tyler Coburn about Ergonomic Futures, a speculative project engaged with art, design, science, anthropology and writing. In this interview, Coburn discusses the research, production process and network of collaborators of a multilayered project ultimately concerned with the futures of humankind. Anna Colin: When one comes across your museum seats Ergonomic Futures (2016—) in contemporary art exhibitions—and soon in natural history, fine art, and anthropology museums—they look… [read more »]

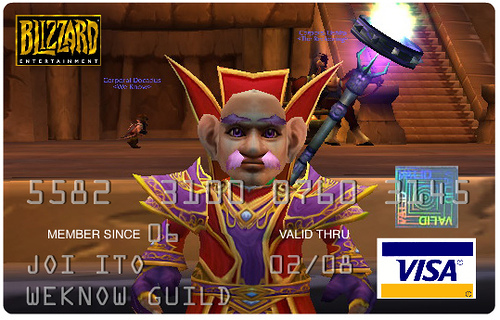

The Next Level’s Debt: Character Skins In The Game

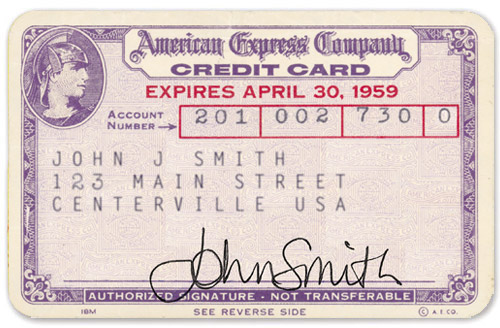

Credit cards are not a battle between good and evil, but a battle between the future and reality. Recently, the debt landscape in the United States has quantum shifted in the direction of reality, away from the virtual. In 2008, regular Americans began paying off their credit cards. In a recession, debt becomes more expensive – not necessarily in terms of credit card interest rates – but more in terms of the value of cash being wasted on repaying debt. Credit tightening doesn’t usually mean drastically higher rates for existing consumer debt (they are already profitably high) – but it means fewer new credit cards. It probably means $1000 dollars in cash buys a little more. It definitely means companies large and small have more trouble borrowing money. It’s better to give gold coins now than to have a treasure map.

Credit crunches because the future is less certain. Statistically, loans in a recession are less likely to get returns. Defaults increase. The virtual reality of debt gets spookier and closer to the hard reality of human economy. We are forced to consider an economy that may not grow as we imagine and hope it will. This most recent level of the masterplastic credit wargame was challenging, with many looming costbots, camping around bends in textured dungeon walls. A bank aims a sniper rifle of surprise fees. A big lumbering housing-crisis juggernaut blocks an exit.

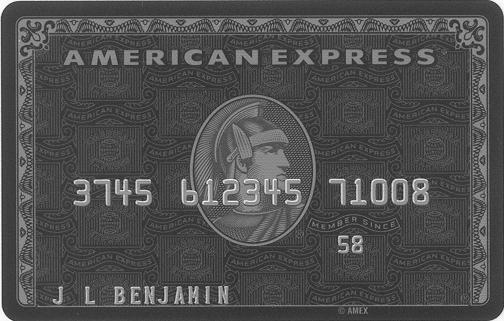

Recently, consumers began taking on debt again. For macro economists, this was a good sign. A sign of consumer confidence. For econofuturists and capital activists, this is an indication that the game-layer of virtual money has swooped in again to cover the real economy with a wonderful +5HP purple cape.

What does the turning tide of credit mean on a global scale? Perhaps it means the recession is over. Perhaps it means real economic value adjustments have occurred. But who knows?

From my PC gaming set-up (custom LED tower, 27-inch monitor, roller-ball mouse), things still seem very grim in the MMORPG of the global economy. With this concrete uncertainty, expect a more spiritual brand of wealth management to emerge in the United States (it already has in India). Expect the unreality of debt and wealth to expand in scale and complexity.

In America, the level boss of all this debt gameplay is perhaps the US domestic government debt – or maybe rising health care costs – or fossil fuel energy prices? There will be an end to this game, however pixeled or un-cinematic. Our virtual lives may continue, though our bodies will get older and we will be less able to work, to procure funds. Our love for abstract rewards goes on infinitely, but our material world will only exist if we can afford to pay the monthly premiums.