<HTML></HTML> Part Two: A Digression on the Arcana of Financial Frontiers

Keywords: Douglas Faneuil, financial industries, Goldman Sachs, High Frequency Trading, Latour Trading LLC, NYSE, occupy wall street, Wall Street

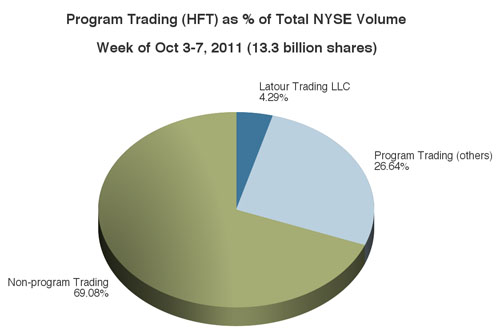

On Monday, October 10th something strange happened in the world of high finance: Goldman Sachs lost its crown. The news, despite trumpeting a major new player in the world of HFT, or high-frequency trading, got no coverage at all from popular media outlets, save for a mention on Matt Taibbi’s blog at RollingStone.com. Yet for anyone with an interest in our fragile economy, the development would have been noteworthy: a new, unheard of company listed as Latour Trading LLC had surpassed Goldman Sachs as the most active trader on the New York Stock Exchange. I googled “Latour Trading” as soon as I read the news. Besides Taibbi’s post and his original citation (hat tip to Zero Hedge), there wasn’t a single article about this new titan of Wall Street—just a few job postings for salaried positions starting at $175,000 (not including bonuses), a YouTube clip of its staff ringing NYSE’s opening bell a few weeks earlier, and up top a link to its homepage, latourtrading.com. When I clicked on the homepage, my browser window went white. I tried reloading it—still nothing. It’s a strange feeling, loading a blank web page; it doesn’t happen very often. So I checked the source code of the site. In its entirety it read:

What does it mean to be the most active trader on Wall Street nowadays? Like infinity, the breadth of high-volume trading is hard to grasp. Before computers came along, or more to the point “algorithm processors,” trading frequency had a natural limit based on two factors: the number of shares that individual traders were willing to buy or sell, and the number of trades those folks could actually book in a given day. As investor money flowed into the US economy, and the number of traders on Wall Street increased, so too did overall trading frequency. But as with so many other things in modern life, computers, to put it mildly, changed the game.

In the 1980s, forward-thinking financial innovators realized that these natural limits to trading, based on our very human physical and mental capacities, weren’t relevant anymore. Computers could trade for us, based on a set of specific instructions, an algorithm, and make a ton of money simply exploiting their speed—or our sluggishness. The beauty of this approach, for greedy traders anyway, is that it’s “market neutral.” With HFT, tech-savvy bankers realized that one could make money from the stock market despite its activity (at least as perceived by human beings). The storied profit-centers of Wall Street would buckle under the weight of sheer processing power. It was the death of investment banking as the world had known it.

Machines for High Frequency Trading (HFT)

Traditionally, legal stock trades had always been based on some form of value and/or speculative investing, in which analysts scour earnings reports and company holdings (not to mention management teams and industry trends) to determine whether a stock is a good buy or sell. This is very difficult work, forecasting future earnings and growth potential. Market neutral investing bypasses all that. If I can buy one hundred shares of Microsoft (MSFT) for, say, $270.40 and sell them less than one second later for $270.41, I’ve just made a penny, or $0.0001 per share. I don’t care how much MSFT is worth, or whether the company will make money next year. If the stock price goes up or down today, it won’t matter. I just made a profit in less than one second, and at the end of that second I have no exposure. After all I’m not holding any investments, just an extra penny. That’s market neutral investing. It replaces one kind of work—analyzing the real worth of stocks—with an entirely different kind: recognizing inefficiencies in the market and writing computer programs to make massive, high-speed trades in order to profit from them.

As in the example above, these market inefficiencies are miniscule, by definition fractions of a penny per share. To make substantial money from these algorithms, banks have to trade millions and sometimes billions of dollars worth of stock per day, all day, generally holding shares from 3 milliseconds to 3 minutes. (The blink of an eye lasts 300-400 milliseconds.) When I worked for a hedge fund in the late nineties, we prided ourselves on this: sometimes, on generally quiet days, the firm’s trading activity alone accounted for ten percent of all trades made that day. This begins to give you a sense of what it means to be the largest trader on Wall Street.

Black Friday, 1987

In theory there’s nothing harmful about high-frequency trading—some academics have argued that it improves liquidity and lowers costs—but in practice HFT algorithms have caused major market crashes and we’re still not sure how exactly. The most recent was the famed “Flash Crash” of May 6th, 2010, in which the Dow Jones Average suffered its biggest one-day point decline ever, 998.5 points, only to recover most of it in just a few minutes (a quick turnaround, yes, but plenty of people still lost money). That’s nine percent of the overall wealth in the market, over a trillion dollars, disappearing and reappearing in the time it takes to get a cup of coffee. A joint report published by two government commissions later stated that HFT algorithms “began to quickly buy and then resell contracts to each other—generating a ‘hot-potato’ volume effect as the same positions were passed rapidly back and forth.” In other words, the algorithms got away from us, and caused the market to tank. The great crash of 1987, Black Monday, is also thought to have been caused, or at least exacerbated, by HFT, but debate rages in part because humans have a hard time assessing the aggregate effects of a flood of ingeniously complex and proprietary (i.e., secret) HFT strategies throughout the markets. Surprise, surprise.

In his wonderful TED talk, Kevin Slavin, a well-known game developer with an interest in algorithms, explains why we’ll never master the ramifications of such complex math. In regards to the Flash Crash, he says,

All of a sudden nine percent [of wealth] just goes away and nobody—to this day—can even agree on what happened. Because nobody ordered it. Nobody asked for it. Nobody had any control over what was actually happening… We’re writing these things that we can no longer read. We’ve rendered something kind of illegible. And we’ve lost the sense of what’s actually happening in this world that we’ve made…

When you see this kind of behavior, what you see is the evidence of algorithms in conflict, algorithms locked in loops with each other without any human oversight, without any adult supervision.

The only power we have over these algorithms, he suggests, is to press the “red button that [says] STOP.” Unsurprisingly, most leaders on Wall Street lack this kind of humility.

So Latour Trading LLC is now one of the largest traders by volume on NYSE. I called them multiple times for comment about this piece, and never heard back (“the person you are trying to reach is not available now…”). After some digging around, I realized I’d missed something: their YouTube clip had some of its caption obscured, and those lines named a CEO, David Faucon. The only webpage in which he undoubtedly appears regards the first criminal conviction in the theft of HFT computer code. Coincidentally, an old friend of my father’s represented the defendant, who used to work with Faucon at Tower Research Capital. (Faucon was never implicated in the crime.) I called Ivan Fisher, my dad’s old friend, and asked, “What can you tell me about David Faucon?” He didn’t remember Faucon at all, but the conversation soon swelled with suspicions about Tower Research and its founder, Mark Gorton. From Tower’s homepage: “Founded in 1998, Tower develops proprietary trading algorithms by using rigorous statistical methodology to identify non-random patterns in the behavior of markets. Exploiting these inefficiencies allows the firm to earn exceptional returns while mitigating risk.”

It turns out that Tower isn’t just the former employer of Faucon. Latour Trading, LLC appears to be affiliated with Tower in some way. They share a telephone number, and both companies are listed at the same address, two floors apart. Fisher tells me this would be “not necessarily inconsistent with [Gorton’s] approach to have people spin off and form companies.” Mark Gorton is more well known as the founder of Lime Group, which owns Lime Brokerage LLC, a brokerage house, LimeWire, the formerly popular file-sharing app, LimeMedical LLC, a medical software company, and Tower Research Capital LLC. Almost immediately Fisher warned me, “I have enormous suspicions about Tower.”

The defendant whom Fisher represented is man named Samarth Agrawal, accused and eventually convicted of stealing HFT code from Société Générale (SocGen), the eighth largest bank in the European Union. Fisher claimed that “Tower held out substantial amounts of money to [Agrawal] for a raid on what amounted to SocGen’s algorithms.” He went on: “The man who designed those systems was also lured to Tower. His whole team went. The top four [engineers] all went to Tower.” Of SocGen’s engineers, Fisher said “they were a huge unit made up of young Indian professionals such as [Agrawal] who had all been educated at this group of universities in India called ITT [he meant IIT, the Indian Institutes of Technology]. These were like MIT plus—they’re regarded as superior to MIT. And these very intelligent people were taught about these strategies,” the complex algorithms at the heart of HFT.

But immediately after Agrawal’s trial, he continued, “they were all out of Tower.”

“They left?” I asked.

“They left or they were fired,” he replied. “I suspect the latter.”

When I told Fisher that Latour Trading LLC had overtaken Goldman Sachs as the largest volume trader, he gasped. “It may be they’re violating some trading regulations. They may be trading on capital that doesn’t exist, because they’re not required to put up the money.”

This is the crux of HFT. If you’re buying and selling the same stocks within milliseconds of each other, what are the capital requirements? Do capital requirements even make sense? In other words, do you have to put up the money? How do you put up money when holdings come and go faster than thought? The trading activity of these algorithms can’t be predicted. Their “decisions” rest on real-time data; they’re crunching numbers at an ungodly pace, and acting accordingly. To ascertain their output—to calculate how much cash needs to be on hand for these trades—you’d need to know an algorithm’s input; i.e., you’d need to know what’s going to happen tomorrow. This is the whole point, of course. These algorithms can’t read the future exactly, but they’re able to construct a picture of the ultra-present by analyzing so much data instantaneously. They “see” what’s happening long before we do, and on a far wider scale. Financial requirements, then, must be stipulated after the fact. And this is indeed what happens: banks with HFT desks generally pony up the cash for their trades on the following business day. It’s a wait-and-see approach. If my algorithm loses $100K on Monday, I’d owe that amount to my broker-dealer on Tuesday morning. But this belies the extent of my activity: that Monday, I actually purchased $312M worth of stocks and managed to sell them all for $311.9M. Ultimately, this cost me $100K. Seems okay when it’s a loss, right? But now consider gains: what if I can make $300K in one day by trading, say, $400M worth of stocks? What do I have to put up? How much do I have to invest in order to earn that money? You might’ve guessed it: absolutely nothing.

Banks will object to this—we can’t trade for nothing, they’ll insist; we have to put up collateral; we have to have money in the bank! This is misleading. Any broker-dealer will demand “collateral” for HFT, but how much is up to that institution. Whatever it chooses, the actual figure must be, by definition, both a tiny fraction of daily stock purchases and a somewhat arbitrary number (as HFT is unpredictable). In other words, this collateral doesn’t function like true collateral, as an asset meant to replace the value of a failed investment.1 Any broker-dealer underwriting HFT assumes a fair amount of risk. In the end, it’s a question of trust. Do I, as a broker-dealer, trust you, as a bank or hedge fund, to effect such massive trades? Obviously, major broker-dealers aren’t going to let any Joe Schmoe engage in HFT. Then again, who is Latour Trading LLC?

Leaving aside the question of whether we should ever trust bankers, it seems rather obvious that we can’t trust them today—and that we can’t trust broker-dealers (like Bear Stearns) to trust bankers. Furthermore, these algorithms are highly coveted, as Agrawal’s crime suggests. Banks divulge nothing about them. Even if a broker-dealer has a math whiz on staff (unlikely), he or she will never get access to the computer code, or even a whiff of its variables. From every angle, then, risk assessment is impossible. But it’s worse than that: were the opposite true, Wall Street would abandon HFT. It’s so lucrative because it’s so arcane. We can’t demand more transparency in HFT; this would be like calling for more transparency in poker. Hidden knowledge is crucial to the functioning of the system.

Much of Wall Street now works this way. Where banks generate astronomical profits, you can bet on secretive, arcane practices. The mortgage bubble, too, thrived on a lack of transparency. For all the similar arcana of highly structured mortgage-backed securities, they were exceptionally lucrative for a simple reason: banks didn’t have to divulge prices. They controlled the market for MBSs, and kept it secret by design. They could set arbitrary prices without fearing angry customers, because no one had access to pricing data. Of course, it’s no coincidence that these securities were themselves super-complicated, and evolved to be ever more so. The harder it is to understand a given market, the more power the market makers have. It’s the economic equivalent of divide-and-conquer: obfuscate and rake in.

I don’t mean to suggest that bankers are sinister, intentionally creating complexity to pillage the economy. Mostly, bankers are just great salesmen, and like all great salesmen they believe their own bullshit. Bankers continue to trust the “quants” on Wall Street—the kids pouring out of MIT to write these algorithms—for the same reasons that we do: trusting them lets us off the hook. It’s a crowded world out there; we’ve got a lot to manage. We farm out our mental capacities all the time: calculators to do easy multiplication, Facebook to juggle our friendships, algorithms to mitigate financial risk. But Democracy demands something of us; if we farm that out, we cease to live in one. Early innovators on Wall Street knew that HFT would look like magic, creating a major profit center out of thin air. The audience—first their peers, then the world—would be impressed by the math, impressed by the technological prowess, but the profits would be most impressive of all. Like teenagers at a magic show, the delight on our faces is finally beginning to fade. In the meantime, we’ve allowed Wall Street to walk away with billions.

Servers for HFT

This isn’t just unfortunate or unfair. Systemic secrecy on Wall Street enables vast disparity of wealth, and this in turn creates a bifurcated society in which the notion of “common good” becomes something of a mirage. To quote Joseph Stieglitz: “Of all the costs imposed on our society by the top 1 percent, perhaps the greatest is this: the erosion of our sense of identity, in which fair play, equality of opportunity, and a sense of community are so important.” This is what our founders feared the most. They celebrated freedom far less than George W. Bush would have you believe. They were much more paranoid about its absence, and did everything they could to prevent the concentration of power. What happens on Wall Street isn’t just a question of equality; it’s a question of Democracy. Capitalism isn’t at odds with human freedom. But what about HFT? Is it even logical to align HFT with capitalism, seeing as it depends so heavily on secrecy, and trades in a world so utterly beyond our faculties? Does Wall Street have the right to make money wherever it can?

Don’t let your iPhone fool you: the digital revolution has just begun. Computers have changed everything, but only a little. The sophistication and complexity of our world is about to become immeasurably, unimaginably richer. But human beings, in one way or another, will always be at the helm (if only with our finger on the kill switch). The wizardry of this new world—in which, for example, our brightest mathematicians spend their time skimming billions of stray pennies from the market like voracious soda-can collectors—may intimidate us. But if we fail to assert ourselves, if we lose faith in our own wisdom and common sense, we’re destined to suffer. The more strange and arcane things seem, the more we have to trust our own, limited judgment. This is the essence of Democracy: faith in the wisdom of common men and women. We may not understand HFT algorithms or MBS tranches, but this isn’t a reason to give up on oversight and defer to experts. After all, were it not for our taxes, these experts would have plunged 6 billion people into the worst financial meltdown in history.

Latour Trading LLC—its shrouded profile, shady history and massive trading schemes—underscores much that’s wrong with Wall Street today. But it would be foolish to vilify this one firm. Investigating them, and prosecuting them if necessary, won’t solve our problems (not that this shouldn’t be done). Other mysterious firms would no doubt follow. The tough questions are for us. Wall Street won’t be forthcoming about the dangers of HFT, but in one unusual circumstance, Goldman Sachs shared its concern. After its employee absconded with precious HFT code, Goldman called the government to warn us. According to a federal prosecutor, “The bank has raised the possibility that there is a danger that somebody who knew how to use this program could use it to manipulate markets in unfair ways.”

- Again, banks will cry foul. HFT strategies may purchase hundreds of millions of dollars worth of stock on any given day, but their holdings at any given moment may be limited to a smaller number—ten million, say. Banks and broker-dealers could base their collateral agreements on this lower limit. This is still somewhat arbitrary. Even if my holdings never exceed ten million, that figure has little bearing on risk. HFT algorithms trade furiously. During a market crash—especially one exacerbated by HFT—these algorithms could lose staggering amounts of money each minute, far more than their fixed holding limits each day.