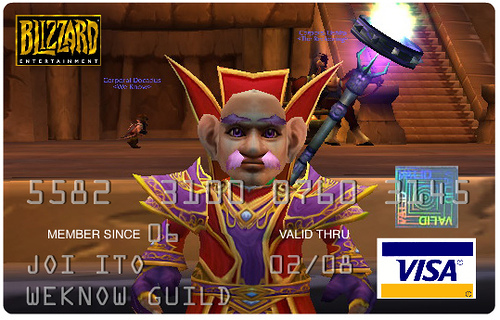

The Next Level’s Debt: Character Skins In The Game

Credit cards are not a battle between good and evil, but a battle between the future and reality. Recently, the debt landscape in the United States has quantum shifted in the direction of reality, away from the virtual. In 2008, regular Americans began paying off their credit cards. In a recession, debt becomes more expensive – not necessarily in terms of credit card interest rates – but more in terms of the value of cash being wasted on repaying debt. Credit tightening doesn’t usually mean drastically higher rates for existing consumer debt (they are already profitably high) – but it means fewer new credit cards. It probably means $1000 dollars in cash buys a little more. It definitely means companies large and small have more trouble borrowing money. It’s better to give gold coins now than to have a treasure map.