Stock Fantasy Ventures – Investment Proposal

Keywords: Andrew Norman Wilson, Bailout, Banking, Business Woman, Finance, Investment Proposal, Markets, Photography, Stock Fantasy Ventures, stock images, stock photography, Yojimbo

Andrew Norman Wilson takes us on a tour through his new startup, Stock Fantasy Ventures.

Stock Fantasy Ventures will serve a global market of cutting edge communicators in advertising, business, art, and journalism with high quality, pre-trend stock photo and video clips.

When we set out to create this investment proposal, we wanted to provide information to enable your investment decision.

You just viewed samples from the first stock image production of Stock Fantasy Ventures: Moping drunk CEO on a thick fur rug wearing unbuttoned Theory dress slacks and wrapped in a KLM airplane blanket receives a call from HSBC Bank and gradually begins to sob while taking their automated customer satisfaction survey. It cost our first investor, the Netherlands-based Impakt, about $1000 to produce, and we project a 600% return on investment within its first year on both the art market and the stock imagery market through sites such as Pond5 and Getty Images.

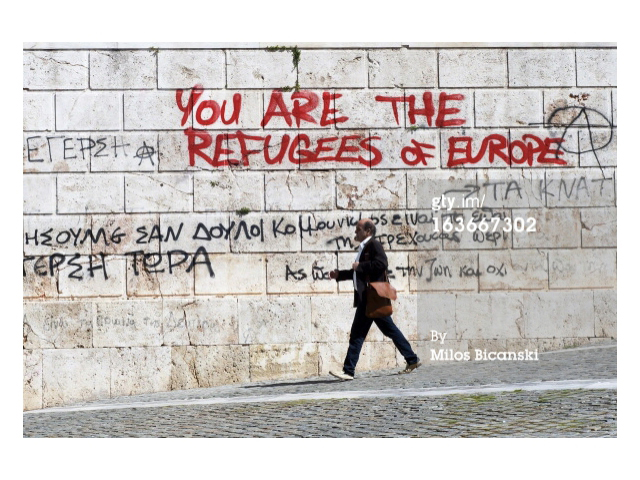

Current offerings of stock imagery through those marketplaces typically present a limited scope of activity, situations, and identity stereotypes. Stock Fantasy Ventures seeks to create alternative representations of finance and business. Recurring themes are financial uncertainty and discontent, disgruntled workers and consumers, and absurdity.

We aren’t just launching a startup, we’re starting a movement. Global communicators spanning the fields of business, art, and journalism are increasingly turning to cost-cutting stock imagery due to the ease with which high quality files can circulate online. These communicators will use our products to entertain, sell, inform, and inspire. Our products are more true to our contemporary moment than current offerings of stock media, filling both a gap in the market and a need in our society.

In 2008, “turmoil” was tenth in the top 10 searches of the Merriam-Webster Online dictionary. “Precipice” came in seventh. But the most searched-for word in 2008 was “bailout.” The word is defined in simple terms as “a rescue from financial distress,” but that simple definition falls far short when describing the social, political and economic impact of “bailout.”

Early in 2008, when Getty Images launched their Financial Services paper, there were already signs that businesses in the financial sector were shifting their messages and visual language to reflect an emerging downturn. While positive escapism may be a real trend in other sectors, financial services have recognized they can no longer credibly sell daydreams. They feel they need to be in touch with the challenging reality their customers face. Gone are the depictions of aspiration and conspicuous wealth as financial services brands try to re-establish trust with their customers.

But “money” and “finance” aren’t actually making sense to people. Just a few years ago, people thought banks had plenty of it, and we’re now discovering that they didn’t, and don’t.

In many instances, financial marketers aren’t hitting the right note. Those that say ‘believe in us’ or ‘we have all the answers’ without the data explaining why isn’t credible given all the wreckage. Others feel it’s comforting for consumers to be treated candidly: “We’re in uncharted waters. We’re doing our best. We want to hear your questions. We’re here to help you.” They feel this adds credibility.

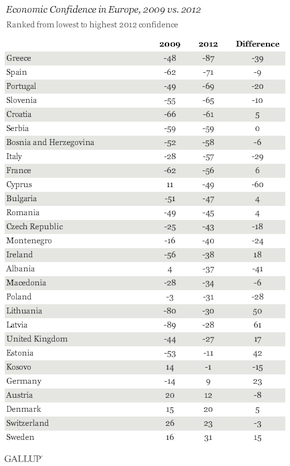

But credibility is dwindling. Economic Confidence in general is net negative in almost all European countries. Germany is the only European country that improved from a negative score in 2009 to a positive score in 2012.

Stock Fantasy Ventures is poised to change the conversation about our economy. We aim to take themes of uncertainty, discontent, even absurdity from the realm of fringe critical discussion of the economy and place them squarely into the mainstream, institutional discussion of what our financial lives look and feel like. By using the existing stock imagery market, Stock Fantasy Ventures allows, for example, the financial services industry to interface with clients through a set of images that is market driven, reflecting the realities of their industry that are truly resonating with their consumers. This then allows them to drive the market in their favor, creating a new relationship with their clients based on dialogue, trust, and self-reflexivity.

Stock Fantasy Venture’s central disruption comes from Marx’s observation that capital posits every limit as a barrier to be forcibly overcome. The limit here–that no one is trusting banks and finance–is placed at the center of a potential rebranding of the financial industry as a responsive entity that understands consumer’s uncertainty and the uncertainty inherent within it. This wins consumer trust by being real with consumers, and in 2013 being real is the only way to do real business.

Whether they know it or not, our competitors are shaping the future – but within a limited scope. Our direct competition uploads media to those aforementioned stock media marketplaces – Pond 5, Getty Images, etc. Our indirect competitors are people hired to make video and photography for their clients. But what neither type of competitor offers is imagery that occupies a dual status as commercially viable images and works of art – they’re more than just stock images because they’re art, and they’re more than just art because they’re also stock images.

A disorientation of goals and disruption of reference points can lead to fits of rage, where the most clear target becomes one’s employer. This theme has been on the rise in popular culture, art, and current events in recent years.

The gradual decline in job security since the 1970s, as well as the lack of the purchase that people can have on their social environment has produced a fading of the belief in the future as a vanishing point which can orientate action and therefore make meaning out of the present.

Now, you may be wondering what is meant by the ‘modes’ listed at the bottom of these slides…

Yojimbo by Akira Kurosawa. 1961. Situated in the mid-19th century collapse of the Japanese feudal system in which a transition from a production to consumption-and speculation-based economy is taking place. The film opens with Sanjuro, a lone samurai, who encounters a town ruled by two rival warlords.

Sanjuro sells his labor to the evil warlords as a means of manipulating and disrupting the established balance of power. At this moment in the film, Sanjuro double crosses his warlord masters by freeing a kidnapped couple, murdering six guards, destroying the building in which they were held, and blaming it on the opposing warlord, effectively pitting them against each other. The samurai, a figure traditionally celebrated as loyal, is found in a new historical context where both existing powers are distrusted and destroyed rather than honored.

Our video concept contributes an update to this image, in which the transition from a production to speculation-based economy is complete. We see an ethnically ambiguous transgender freelancer, presumably having sold herself for provisional work with a financial services company. The freedoms of the freelancer are shared around the globe – freedom from social bonds, freedom from solidarity, freedom from certainty or predictability, freedom from property. She sells her intellectual property to this corporation, it becomes their property, and this then generates capital through which they purchase additional property – partially in the form of office space and furniture. The freelancer recognizes that these concrete manifestations of the corporation’s capital – are just like her – cheap, disposable, interchangeable, unattached.

The Bitter Tears of Petra Von Kant by Rainer Weiner Fassbinder. 1972. The film has an all-female cast and is set in the home of the protagonist, a prominent fashion designer named Petra von Kant. It follows the changing dynamics in her relationships with the other women. Petra falls in love with a woman named Karin, and Karin begins to model for her. But Karin quickly abandons Petra and decides to return to her husband, after arming herself with the professional contacts and experience she’s gained as a model. Yet Petra is not without fault. Having spurned her husband for trying to assert economic control over her, Petra has simply repeated the process with Karin through her materialist concept of love.

In this scene we find Petra, post-abandonment, in her bedroom – a great wilderness of white shag carpet in which she flounders in an alcohol-pickled rage, hopelessly awaiting a call from Karin.

As you saw, a well-bred woman in designer clothing anxiously awaits a call, and receives one, but from a female automaton – requesting her to engage in a customer satisfaction survey. The woman reflects on her extremely negative customer service experience and begins to sob. Themes of manipulation, physical and emotional alienation, and materialism remain, but the failed relationship in Fassbinder’s film is shifted through our video from a love interest to a retail bank, from fantasy in the flesh to an abstract electronic voice representing a corporation. Our protagonist is surrounded by and clothed in new materials, machined surfaces, and abstraction in the service of pure design.

A single stock image concept yields a variety of products on the marketplace. We have a moping drunk CEO, a moping drunk CEO taking a call with a bluetooth earpiece, a moping drunk CEO sobbing, a moping drunk CEO in crisis on her carpet, a CEO applying makeup, and so on. But she could also be a gallerist, a PR firm director, a journalist, an actress…

An investment in a stock image concept generates 5 video clips, 5 print-quality photos, and 5 online-quality photos. For each clip or photo sold through a stock media marketplace, the investor will have a 50% return. We expect 3 of each image type to sell within its first year on the stock media market.

On the art market the video clips will be sold as a package for $5,000 and framed prints will sell for $8,000 each. For each clip package or photo sold on the art market (through a gallery or dealer), the investor will have a 25% return. We expect 1 video clip package and 3 framed prints of each image type to sell within it’s first year on the art market. Based on that the above chart summarizes net profit for investors in the first year for each stock image concept:

Remember, Stock Fantasy Ventures isn’t just a startup. It’s the start of a movement.

To find out more, download our executive summary here.