The price of debt

Keywords: ada o'higgins, ahmet ogut, artist debtors, bankruptcy, certainty of hopelessness, Christopher Glazek, college tuition, corporations, day after debt, Debt, debt collective, default loan, Discussion, hannah appel, rolling jubilee, Sean Monahan, strike debt, student debtors

Is the price of debt worth the promise of a college education?

Nietzsche proposed in Geneology of Morals that humans are “animal[s] that [are] entitled to make promises.” Most college students sign promissory notes to pay for their education, thereby signing away a portion of their future. But while students were once guaranteed a practical skill-set and well-paying career, college graduates now find themselves struggling to get jobs they are overqualified for and floundering in debt.

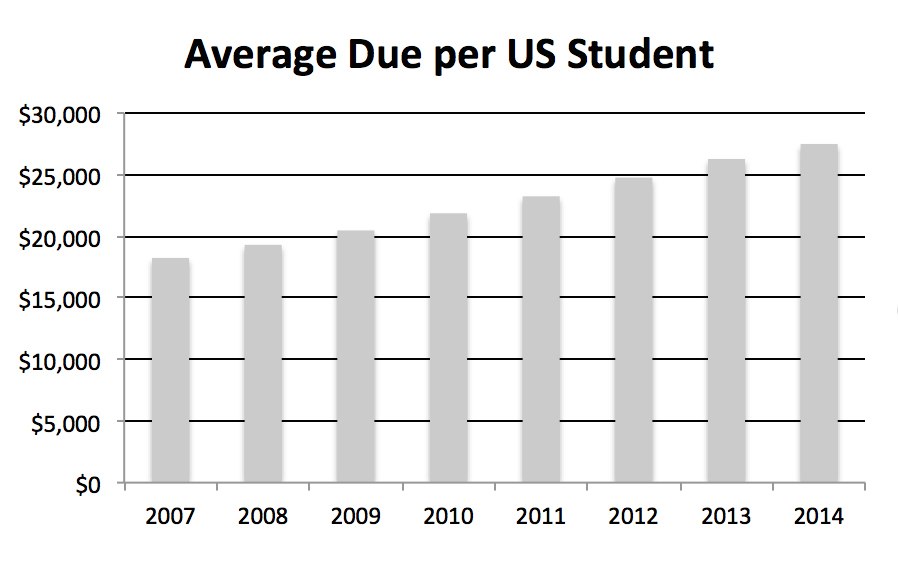

The cost of college tuition has more than tripled between 1973 and 2014. Americans have an average of about $30,000 worth of student debt, and one in ten borrowers default on their loans. In light of the staggering debt it engenders, is an American college education still worth the fee?

To discuss the the economic and social dimensions of the debt crisis we are in, writer Christopher Glazek, Hannah Appel, member of the Debt Collective, Sean Monahan, member of K-Hole, and artist Ahmet Öğüt, initiator of the Day After Debt exhibition, got together with Ada O’Higgins on Google Hangout.

For those of you trying to get your college debt discharged, Sean Monahan and Christopher Glazek’s pamphlet, The Certainty of Hopelessness: a primer on discharging student debt, originally published by N+1, is now available for DIS readers!

N.B This article is being annotated using Genius. To view and reply to annotations, click on the yellow highlights.

Ada: Sean and Christopher, one of the themes behind the Certainty of Hopelessness pamphlet is the idea that student debtors, like corporations, should take a more adversarial approach to discharging debt. Can you tell us more about that?

Sean: It’s not a fully developed idea, but it goes behind the project. There’s a double standard with how individuals and corporations are treated in terms of debt.

Hannah: They do things with their debt obligations all the time, they sell them as derivatives.

Sean: When you’re thinking about debt and financial markets, it’s important to abstract yourselves a bit. Individuals treat borrowing from corporations like borrowing from their friends. It’s about empowering yourself, realizing that owing money to a corporation is not like owing money to your mom. To a corporation you are an abstraction—it’s not a personal exchange.

Ada: Where do you pinpoint the genesis of the debt crisis?

Sean: There’s been a shift in consciousness where people no longer think of education as a public good, they see it as a private investment in human capital. That semantic transition has shifted responsibility to individuals.

Hannah: Explaining it as a consciousness shift is helpful. A radical change in taxes. There’s less public money than there has ever been before. And what takes that place is credit, but credit was radically democratized in the same timeframe as public money diminished.

Sean: At the same time all those transitions you mentioned are happening, you also have these Silicon Valley narratives that valorize innovation and failure. It’s important that credit is available for people to try out new ideas (i.e innovate, fail forward), but it’s equally important that those debts can be discharged in bankruptcy court. The exceptional nature of student debt is that it can’t be. If you want people to participate in a high stakes economy, you have to allow them to discharge debts. That’s the real problem with student debt in particular.

Hannah: Debt can be productive. What does productive and sustainable debt look like, and what does illegitimate debt look like? People should not have to go into exploitative debt for the basic things they need to survive. The question is what are the public options available. So people are choosing to go into a debt contract rather than doing it to survive.

Chris: I think one of the points of the Debt Collective is to remove the shame surrounding debt. One of the objectives of the pamphlet is also to encourage shamelessness in the way that individuals approach debt.

Sean: To add to that, the gesture of the pamphlet was also to be humorous. We were focused on the criteria on how to discharge debt. And you end up with an absurdist situation, where you end up having to cut off one of your legs. I think outrage is important, but its also important for people to think about the implications of the way we’ve currently written our laws.

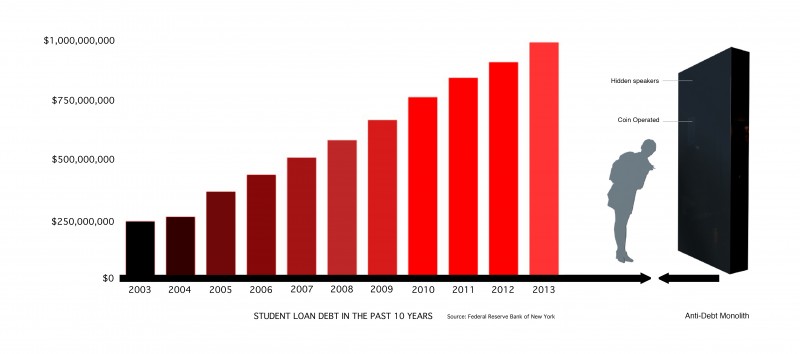

Ahmet: The Day After Debt exhibition is the first step in a long-term counter-finance strategy that secures the control over the future of the art work; control over surplus. The six sculptures in the exhibition will function as collection points for public contributions to student loan debt relief. In addition, as part of the project we worked with an art lawyer to develop a Letter of Agreement between the artists and potential future owners: all present and future proceeds collected by the sculptures will go to Strike Debt and the Debt Collective.

The exhibition featured six fully functional sculptures; including works by Natascha Sadr Haghighian, Dan Perjovschi, Martha Rosler, Superflex, and Krzysztof Wodiczko. Mine is a coin operated “Anti-Debt Monolith.” When you insert a coin inside, it activates an audio recording that addresses the growth of student debt in the past 10 years in addition to collecting money.

Hannah: As an organizer with Strike Debt, I think collaborating with artists in the long-term feels like an important beginning. Debt in many ways is fundamentally about time––interest accumulates over time; payments spread out over time; so collective action will also have to unfold over time.

Ada: What about the parallel between student debt in academia and artist debt in the art world? Christopher talks about this question in his recent article for the NYTimes.

Ahmet: A personal anecdote: when I finished University, I was in debt, but I didn’t have the resources to pay it back. At that time a collector approached me. He asked the price of a piece, and I said well this piece doesn’t have a price, the price is the amount of money that I need to pay back to the government for my studies. It was a good deal for both of us, he paid that back for me and got the piece.

Ahmet Öğüt, Anti-Debt Monolith, 2014. Courtesy the artist, photo courtesy Aaron Word.

Christopher: That’s funny, it kind of calls to mind another interesting emergent phenomenon, which is the fetishization of the student debtor, an important theme in rent boy and prostitution circles. There’s this fantasy of this really strapped student who on a website (e.g seekingarrangements.com) will say ‘I need help paying back my student loans, I need a sugar daddy to help me do this’, which is an interesting erotic aspect of the problem. The expenditure on a kind of sex object is obviously complicated, multivalent, and time honored, and you can buy expensive things to convey your affection, but increasingly something people seem to literally get off on is helping someone absolve their debt. It’s also the kind of thing you’re “allowed” to ask for, in addition to asking for expensive coats and things like that.

Ada: So what do you guys think are the ways that we can practically change student and artist debt?

Hannah: Student debtors who are also artists are also part of much broader categories. Not only are they part of the category of student debtor, but they’re also part of the category of consumer debtor more generally. This creates potential solidarity and power with people with mortgage, people with medical debt, people with pay-day loan debt, people with criminal justice debt.

We saw in the wake of what’s going on in Ferguson, the municipality of Ferguson makes 40% of its income off of criminal justice fines, which is putting all of those people into debt. So, the category of consumer debt is vast and a potentially politicizable category. I think artists should jump into that, and are jumping into the politicization action that can potentially unite all of us. That is how I understand the beginning that we’re at now. We are moving towards that collective act of refusal, of reimagining debt, of garnering collective power towards refusal, renegotiation, and reimagination. In fact, the Debt Collective will have a major announcement to this end coming soon.

Christopher: This is an opportunity for artists, who are maybe not the most high-profile category of debtors, or maybe are more high-profile than they should be, to make common cause with the larger extended population that needs to politicise around these issues.

I mean it does raise the question of whether artists’ participation and struggles against debt should be taking place only within the art world, or should be taking place totally outside of the art world. How do those things meet? In a way you might argue that making artwork that obliquely implicates debt issues is low impact. I don’t know.

Superflex, Academic Square Cap upside down, 2014. Courtesy the artist, photo courtesy Aaron Word.

Ada: Art can be made for practically no money, yet the price of art school continues to rise. What are some possible alternative education models?

Hannah: We begin with resistance, refusal, and new ways to understand debt. But then the next step is of course to change the way that education is financed. It doesn’t make any sense to successfully resist debt of any kind without then changing the socioeconomic systems through which it was incurred. So if you look at How far to Free, we have a very detailed plan of what it would take to fund free higher education for every two and four year public college in the U.S.

Ahmet: Thinking about alternative models of education is a creative task for everyone. Deschooling Society, by Ivan Illich in 1971, has already pointed out the ineffectual nature of institutionalized education. And what is this ineffectual side? It’s the costs, which do not go directly to logical needs. We have to start from ground zero when we think about what are the ways to imagine solidarity-based school culture independently from oppressing financial structures.

Sean: A big part of art education that we’re not addressing when we talk about rethinking higher education in a broader way is that people who go to art school are especially concerned with credentialing and networking. When people think about their education in terms of a name brand degree, which is definitely what a lot of people are looking for when they shop for MFAs, it becomes a bit harder to argue against that. These are luxury purchases, and they’re made with the expectation that this will allow them to engage with a certain class of people, and have entry into certain circles where their work will have currency. Pedagogical concerns— the idea that you can be a self taught artist—it’s an interesting possibility, but many of the artists and students who are in debt are electing to enter that system of high debt.

Christopher: Well sure, but there’s something that actually does make a system of debtors in the art world especially well positioned to address student debt more generally. As Ada was pointing out before, we live in an age when art can be made from nothing, the sort of highly fictional nature of everything that’s going on, is even more exposed and clear in the art world.

Money in the art world is already such a funny, magical, kind of post-rational thing, with auctions and so on. At the same time there is this very expensive entry price, when the kind of training being bought is meaningless in a lot of educational fields. It’s largely a credentialing mechanism, even when you talk about History degrees. Even with people who are becoming academic historians, you can make the same argument. In the art world though, the kind of flimsiness of a lot of these price structures and of the concept of training is much more obvious. Which actually makes the art world an especially good place to start focusing attention on these questions. Not everything is the same of course, but I think that it’s not a bad place to start talking about student debt because the degrees are so expensive, and the real impact of the training is so mysterious- the reality is that you’re really paying for access to an elite crowd. It points to all the issues surrounding student debt in such a stark way, and the people who are involved are purportedly the best at communicating those issues too.

Ada: People are more willing to question the value of an art degree compared to other degrees and maybe they should be having that same critical stance towards other areas of higher education.

Christopher: Yes, and the extent to which the real value proposition is about guild membership, in some kind of institutional structure that has these very high entry points. I think that characterizes a lot of fields: not just the arts. Its just much more obvious in the case of art. I think that is kind of a powerful way to understand what’s going on in many corners of the university system.

Natascha Sadr Haghighian, Donation Tower (former value $10,000), 2014. Courtesy the artist, photo courtesy Aaron Word.

Sean: I agree, but this also just points out that a lot of student debt is literally the price of social mobility—the people who don’t have access to elite networks are the most ready to pay ostentatious price tags to access them. Some of the people with the most outlandish amounts of debt are people who are going to for-profit universities and have a weak understanding of what the meaning of those degrees are. I think it’s really easy to imagine someone accessing elite art world circles without actually having any credentialed art training and I’m sure there are many people that fit that profile—but they probably have the privilege of other points of access.

Christopher: Right! Which is another reason why it’s an electric space because it’s simultaneously the argument that you really don’t need this at all and you can just become an Instagram celebrity and then become collected by important people. The tantalizing prospect of an entirely alternative route to success is also foregrounded in a really stark way in the art world.

Sean: I agree with you, I think the idea that you don’t really need this is dependent on who you’re talking about? If you’re an Instagram celebrity you can short circuit these networks. If you’re not then the question of how you approach education and how much you think you should be paying for it changes entirely.

Christopher: I don’t know if that’s really true: whether an art degree is actually any more or less required for professional advancement in the field than it is in say, medical fields or law. There probably is a right answer to that question, but certainly the myth that the degree isn’t adding anything, and is maybe somehow part of the problem, is that much more powerful in the art world.

Student loan debt in the past ten years

Ada: Hannah, I was thinking about the Debt Collective and how you are trying to solve the problem for students that are currently in unresolvable debt. According to the Debt Collective, what are the steps that should be taken to address the underlying causes of the problems in the longer term?

Hannah: The Debt Collective is an autonomous project of a bunch of us who have worked with Strike Debt and the Rolling Jubilee. It’s our next big push and its building the capacity of debtors toward collective action–the ability to refuse debt through the credible threat of debt strikes, and then renegotiate debt, and eventually reimagine it in the systemic ways that we’re talking about it.

The first group of debtors that we’re working with have been students from Corinthian Colleges Incorporated, which was one of the nation’s largest for profit college corporations, but it failed and went under. As is true with many corporations since the financial crisis, it has been bailed out by the government.

The specific part of the US state that is bailing it out is the Department of Education, the DOE. The DOE actually has it in its mandate to discharge the debt of current and former Corinthian students because the school has been accused of fraud. Corinthian was blatantly a fraudulent corporation (essentially a loan shark) masquerading as a school. The DOE has it within its power to discharge students who incurred debt under fraudulent circumstances, but not only is the DOE not doing that, but it has facilitated the sale of this corporation, wait for it….to a debt collector (ECMC) who is now going to run it as a school called Zenith.

ECMC had been working for years and years as the government’s student debt collector. Now, the DOE has facilitated the sale of Corinthian to them. Behind closed doors, the DOE has essentially worked very closely with Corinthian, the now-failed corporation, to sell off its assets to a willing buyer. The DOE has essentially worked as a middleman.

Christopher: That’s crazy! And when you use the phrase bailout, does that have some specific meaning in this context, are you being metaphorical or is there…

Hannah: No, I am not being metaphorical, I think that if Corinthian were to just go under, if we were to let Corinthian fail, in a very historical analogy, the bondholders would be on the hook for whatever they were on the hook for, the taxpayers would be on the hook for discharging student debt, insofar as DOE gets its money from taxpayers. There would have been very specific, but in my opinion preferable, consequences had that corporation failed. And instead of doing that, which is well within the DOE’s mandate under current law, the DOE has chosen to bail out this corporation by finding a willing buyer for their assets so none of those potential effects come to pass.

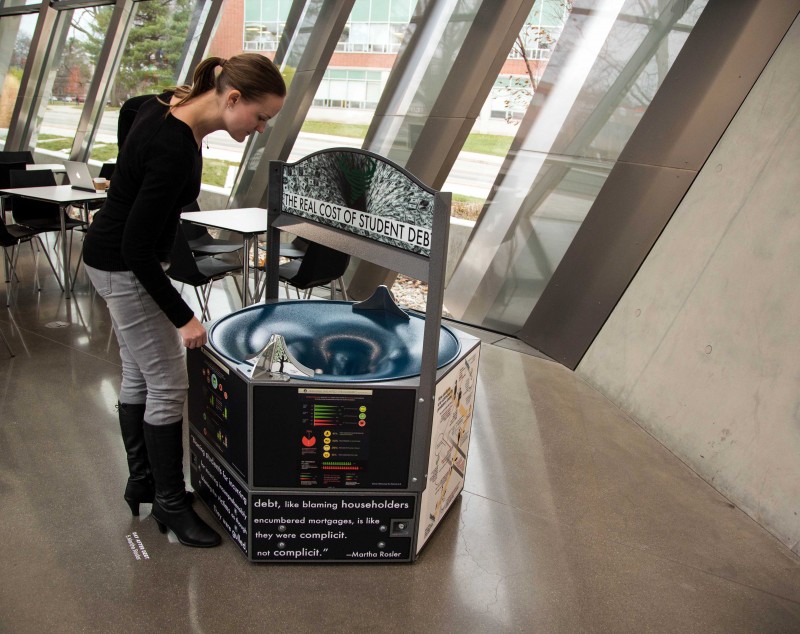

Martha Rosler, Coin Vortex for Student Debt, 2014. Courtesy the artist, photo courtesy Aaron Word.

Ada: What is the Debt Collective’s process as an activist group?

Hannah: I think the easiest analogy is the union and the history of collective action in labor. As finance capitalism increasingly reshapes industrial capitalism, the question becomes, what happens when so few of us have access to the power of unionization? So few people around the world have access to that sort of collective organizing on the factory floor. As the sources of profit in our economy move from industry to service to finance, one effect is the kind of isolation that Ahmet was talking about. Where in the past people may have shared a factory floor, as non workers, as people out of work, in an economy where profit is generated from finance, we don’t share a factory floor with those people any more. What we do share is the category of being indebted. So in a certain way there’s an analogy to a union, but the geography of it, the spatiality of it is very different. So how to find collectivity when we don’t share physical space is something that we’re really working on.

Ada: Sean, have you noticed any cultural shifts related to our debt culture–for example, have you noticed a trend right now for artists to not get MFAs and try and depend less on higher education?

Sean: I do think there is a trend towards people skipping MFAs. But maybe a broader and more interesting cultural shift that connects more with what the Debt Collective is doing is that we’re really living in an affect economy right now, and I think that a lot of this conversation touches on that. The idea of using lawyers to attack debt really addresses the fact that solidarity isn’t enough anymore.

Just agreeing with people, or clicking like, or reading people’s personal essays about the financial trouble they’ve gotten into due to their education isn’t enough. Even though it can feel satisfying to agree with some of these broader social movements, actual change happens through addressing power structures in a more active way. So I don’t know if that’s necessarily a trend, but I think that the Debt Collective is trying to find a way through the affect economy— a more productive path.

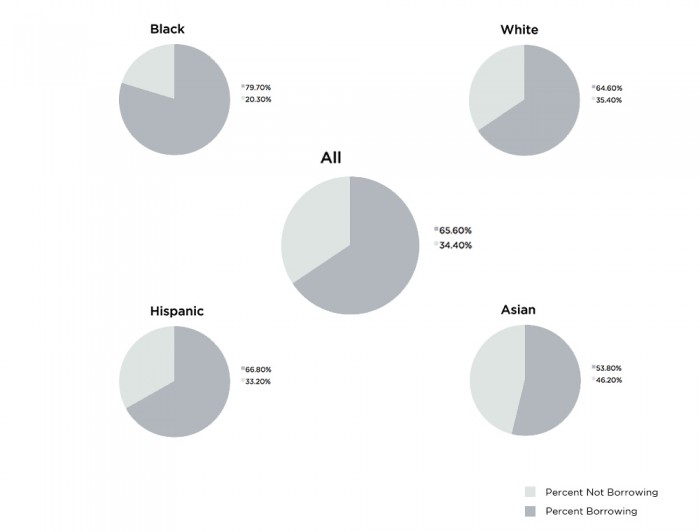

Source: US Department of Education, National Center for Education Statistics, “Baccalaureate and Beyond” Study, 2009 *most recent data

Ada: Obviously social media has helped a lot with mobilizing people and connecting activists, but at the same time it has possibly facilitated a trend of apathy where clicking on something becomes sufficient action.

Sean: I don’t think the problem is apathy, I think the problem is that it’s satisfying to show emotional solidarity with other people’s problems, and there’s a certain self righteousness to formatting a movement around agreeing with other people’s experiences and validating their experiences rather than actually doing the real work that it takes to change what those experiences are.

I think that maybe you can see a corollary to the discussion about student debt, in terms of adjunct pay. There are obviously a lot of people who are tenure track or tenured on college faculties. They definitely agree that adjuncts should be getting paid more, but how agreement actually helps that become a reality is a little fuzzier. I think that the problem isn’t necessarily that people don’t care, but that they feel that caring is enough. So I think that apathy might not be the right way to frame some of the issues in creating social change.

Ada: What is the most extreme, utopian solution you can imagine, and what is the most realistic?

Hannah: The extreme utopian solution is mass cancellation of all illegitimate debts, not just student debt, and a radical rethinking of how we finance our basic needs: education, healthcare, housing. Moreover, we have to rethink our entire economic system away from an ill-understood addiction to growth, and toward a serious consideration of climate debt, reparations debt for African Americans and Native peoples. We have serious utopian work to do. Realistically, debtors unions are the first step toward collective power and the near-term renegotiation of debts. That’s the work the Debt Collective is doing.

Ahmet: I agree with Hannah: the ultimate utopian solution would be completely repurposing higher education to a decentralized, participatory, and autonomous modality of education, instead of a centralized and authoritarian one that operates within the parameters of oppressing financial and administrative structures. A realistic solution would be creating micro-scale self-organizations, focusing on specific counter strategies like targeting and renegotiating administrative costs.

Sean: I think the most realistic path forward will probably grow out of President Obama’s initiatives with Income Based Repayment plans and free community college degrees. Hopefully both of these plans can grow to relieve a larger number of debtors (expanding Income Based Repayment to cover private loans and consume a smaller amount of disposable income) and expand opportunities to get basic degrees debt-free (adding grants to cover living expenses for community college students.)

Ada: What about the glamorization of Art degrees and Humanities degrees: should we try and change a culture where anyone is told they can be an artist if they go to art school, a journalist if they study journalism, etc?

Ahmet: Art students need to get away from the idea of individual success and competition that is built on individual debt. Statistics of BFA/MFA/Phd give a clear answer to your question; out of 2 million arts graduates nationally, only 10 percent (around 200,000 people) make their primary earnings as working artists. Only 16% of working artists have an arts-related bachelor’s degree. I would say students can easily study something else, but keep doing art.

Sean: Yes and no: the idea that there is a linear path to creative success through credentialing is patently untrue. At the same time, I don’t like the idea that only some people should become artists and journalists. Implicit in that assertion is the idea that these positions are only available the privileged elite. I want culture to be more representative—student debt is one way to let people try their hand at breaking into those fields. I just want there to be a path out of debt servitude if their expensive lottery ticket turns out to be a dud.

▾ Download Certainty of Hopelessness

Hannah Chadeayne Appel is a professor at UCLA and holds a PhD in Anthropology.

Sean Monahan is a member of NY based artist collective K-Hole.

Christopher Glazek is an author and the executive editor of Genius. Read his most recent article for the New York Times, on the ‘Art World’s Patron Satan,’ Stefan Simchowitz.

Ahmet Öğüt lives and works in Istanbul, Amsterdam and Berlin. He has recently initiated The Silent University and Aciliyet Mektebi (University of Urgency). A recent collection of his work, Tips and Tricks, is available from Mousse Publishing.

Transcription and editing Nic Burrier

Code Jon Lucas